Terminology Guide - "F"

Fade: A gradual decline in share price.

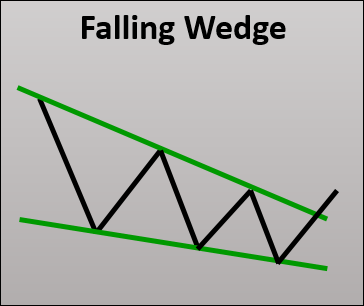

Falling Wedge: A bullish reversal pattern in which two downward trend lines are converging. When the price breaks out over the upper downward trend line, the stock signals a reversal.

Fibonacci Retracement: Fibonacci retracements are key levels that are calculated by taking two extreme points (high and low) and dividing the vertical distance by the Fibonacci ratios of 23.6%, 38.2%, 50%, 61.8% and 100%. Watch THIS VIDEO to learn how to draw and use them.

Flag: A continuation pattern that is commonly used by momentum traders. It is a trend channel pattern that follows a sudden price move to the upside or downside. See THIS VIDEO for more info.

FOMO: Fear Of Missing Out. The most painful aspect for an emotional trader comes when they cannot decide whether or not they should break their own rules to enter a trade due to its appeal.

Futures: Futures are financial contracts that obligate the buyer to purchase an asset (or seller to sell an asset), such as a physical commodity or just a financial instrument. Futures contracts track the underlying asset and is usually are traded with higher leverage than that of equities.

[btnsx id="2748"]